SunShine Review

«SunShine» - Loan company summary:

Navigating the world of short-term loans can be challenging, but our comprehensive review of Sunshine Loans aims to provide you with clear and concise information to help you make an informed decision. This review covers various aspects of Sunshine Loans, including the types of loans they offer, the application process, interest rates, customer service, and their commitment to responsible lending. Our objective is to present a balanced perspective, highlighting both the strengths and areas for improvement, enabling you to determine if their services align with your financial needs and circumstances.

Experiences with Sunshine Loans

Navigating the financial landscape of loans and borrowing can often be overwhelming. However, Sunshine Loans strives to simplify this process, offering a straightforward and hassle-free user experience. Borrowers frequently commend the simplicity of the application process and the speed with which they receive their funds. The company’s online platform is designed to be user-friendly, facilitating smooth navigation with readily available and easily accessible information.

Sunshine Loans focuses on short-term lending solutions, tailoring their services to meet immediate or emergency financial needs. This specialization ensures that borrowers receive products that are well-suited to sudden or unexpected financial obligations, providing a sense of relief and support when it is most needed.

Who Can Apply for a Sunshine Loans Loan?

Sunshine Loans has established specific criteria for eligibility. Applicants must be over 18 years of age, ensuring they are legally able to enter into a financial agreement. Additionally, they must be residents of South Africa, which ensures a level of locality and accessibility for both the borrower and the lender.

Employment is another crucial criterion; applicants must be employed and receive a regular income. This requirement is standard in lending, providing assurance regarding the borrower’s ability to repay the loan. Sunshine Loans emphasizes responsible lending practices, ensuring loans are granted only to individuals with the financial capacity to meet repayment obligations without undue financial stress or hardship.

Differences from Other Loan Providers

Sunshine Loans distinguishes itself from other loan providers through its focus on simplicity, speed, and accessibility. Unlike some lenders who require extensive documentation and a lengthy approval process, Sunshine Loans prioritizes a swift and straightforward application process. This approach is particularly beneficial for individuals facing emergency financial situations where time is critical.

Another key differentiator is the company’s commitment to responsible lending. While the objective is to provide financial support, Sunshine Loans also emphasizes ensuring that borrowers are not placed in a position of financial vulnerability due to taking out a loan. This balanced approach reflects a care for the financial well-being of borrowers, ensuring the loan serves as support rather than a financial burden.

Selecting the right loan provider is crucial for managing your finances effectively. Whether you’re looking for lower interest rates, better customer service, or more flexible repayment options, our guide on the best loan providers in South Africa will help you navigate your options.

What Makes Sunshine Loans Unique?

Sunshine Loans offers a range of short-term loan options tailored to meet specific immediate financial needs. What sets Sunshine Loans apart is their commitment to simplicity and speed in the loan application and approval process. Borrowers can expect a hassle-free online application, quick decision-making, and fast disbursement of funds, ensuring that urgent financial needs are met promptly.

Advantages of Choosing Sunshine Loans

Comparing Sunshine Loans with other lenders reveals several advantages. The company’s focus on short-term loans makes it a go-to option for borrowers seeking quick financial solutions without long-term commitments. Their transparent fee structure and responsible lending practices add to the appeal, providing borrowers with a clear understanding of the costs involved and ensuring that loans granted align with the borrower’s ability to repay.

Types of Loans Offered by Sunshine Loans

Sunshine Loans offers a variety of loan products tailored to meet different short-term financial needs:

- Payday Loans: Designed to bridge the gap between paychecks, providing immediate funds to cover unexpected expenses. These loans are typically small, with repayment aligned with the borrower’s next payday.

- Emergency Loans: For those facing urgent expenses, such as medical bills, these loans provide quick access to funds, ensuring that financial needs are met without unnecessary delays.

- Cash Advances and Quick Cash Loans: These loans are designed for speed and convenience, making them suitable for situations where quick access to cash is a priority.

In each case, Sunshine Loans emphasizes a simple and fast online application process, aiming to make the borrowing process as straightforward and quick as possible for customers.

Requirements for a Sunshine Loans Loan

When considering a loan with Sunshine Loans, it’s essential to be prepared with the necessary documents and information to expedite the application process. Typically, Sunshine Loans requires borrowers to provide:

- Proof of Identity: Valid identification to verify your identity.

- Proof of Income: Documentation such as pay stubs to verify your employment and income.

- Recent Bank Statements: To assess your financial situation and ability to repay the loan.

This ensures that Sunshine Loans can accurately assess your ability to repay the loan and determine the most suitable loan amount and terms for your situation.

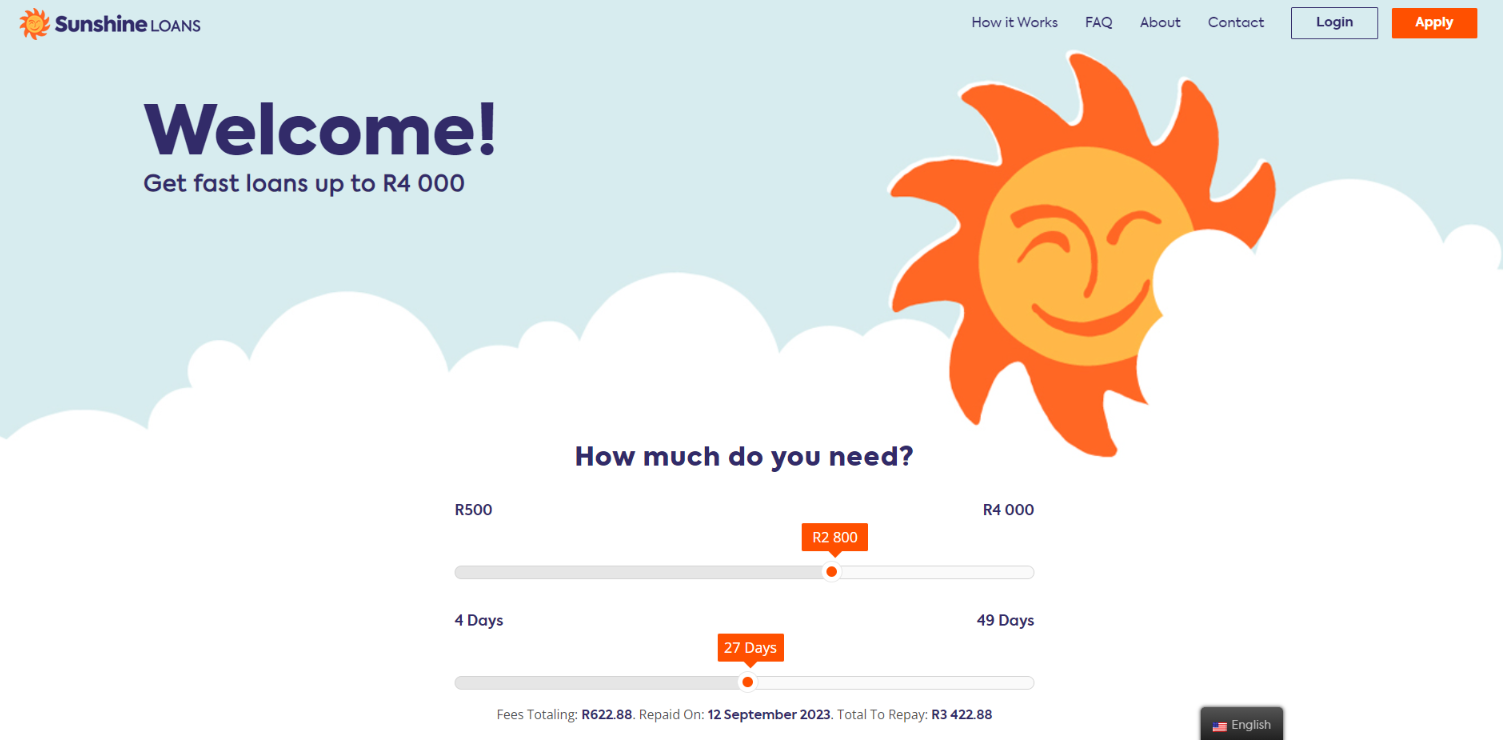

Simulation of a Loan at Sunshine Loans

- Visit the Official Website: Start by navigating to the official Sunshine Loans website. This platform provides comprehensive information about available loan products and is where you will initiate the application process.

- Choose the Desired Loan Type: Explore the various loan products offered by Sunshine Loans. Select the one that best suits your financial needs, whether it’s a payday loan, emergency loan, cash advance, or another type of short-term loan.

- Online Application: After selecting the desired loan type, proceed to fill out the online application form. Provide accurate and complete information about your personal and financial details, including your name, contact information, employment details, income, and other relevant information.

- Upload Necessary Documents: Prepare the required documents, such as proof of identity, proof of income, and recent bank statements. Use the online portal to securely upload these documents as part of your application. Ensuring that the documents are accurate and up-to-date can expedite the processing of your application.

- Review and Submit: Before submitting your application, carefully review all the information you’ve provided to ensure there are no errors or omissions. Submitting an accurate application increases the chances of a smooth approval process.

- Wait for Approval: Sunshine Loans typically processes applications promptly. While waiting for approval, stay attentive to any communications from Sunshine Loans. They may provide updates or request additional information during this stage.

- Loan Disbursement: Upon approval, the loan amount will be transferred to your specified bank account. Sunshine Loans aims for fast disbursement, often on the same business day. Monitor your bank account for the funds and use them as needed.

Eligibility Check

Before applying for a loan, Sunshine Loans offers an online eligibility checker tool. This tool allows you to input basic details, such as income and the desired loan amount, to get a preliminary idea of your eligibility. Use this tool to gauge your likelihood of loan approval before proceeding with the full application.

Security and Privacy

Sunshine Loans prioritizes the security and privacy of your personal and financial information. They employ advanced encryption technologies to protect data transmitted through their website. Comprehensive privacy policies are in place to outline how customer data is collected, used, and protected. Sunshine Loans aims to build trust by being transparent about their data handling practices, ensuring a secure and reliable service for customers.

Refer to the specific terms and conditions outlined by Sunshine Loans for detailed information on the application process, eligibility criteria, and loan terms.

How Much Money Can I Request from Sunshine Loans?

When applying for a loan with Sunshine Loans, the amount you can request varies based on the type of loan product you choose and your financial circumstances. Typically, the minimum loan amount is R500, while the maximum can go up to R4,000. Sunshine Loans assesses each application individually, considering factors such as income level and repayment ability, to determine the most suitable loan amount and terms for each borrower.

Sunshine Loans offers personalized loan terms, tailoring the loan to meet the specific needs and financial situation of each applicant. This personalized approach ensures that borrowers receive loan offers aligned with their repayment capabilities, promoting responsible borrowing and lending.

How Long Does It Take to Receive My Money from Sunshine Loans?

One of the standout features of Sunshine Loans is the speed at which they process loan applications and disburse funds. On average, the approval process is swift, often completed within one business day. Once approved, the funds are typically transferred to the borrower’s bank account promptly, ensuring that urgent financial needs are met without unnecessary delays. However, the actual time to receive the money can vary based on factors such as the applicant’s bank and the timing of the application.

How Do I Repay My Loan from Sunshine Loans?

Repaying a loan from Sunshine Loans is designed to be straightforward. Repayments are usually aligned with the borrower’s pay cycle, and the amounts are directly debited from the borrower’s bank account. This automated repayment process simplifies the experience, reducing the risk of missed payments.

It’s also crucial to be aware of potential fees and penalties associated with the loan. While Sunshine Loans strives for transparency in their fee structure, borrowers should ensure they fully understand any additional costs that may apply, such as late payment fees, to avoid unexpected charges during the repayment process.

Pros and Cons

Pros

- Quick Approval and Disbursement: Sunshine Loans offers a rapid application and approval process, often disbursing funds within one business day.

- Online Convenience: The entire loan application process can be completed online, providing a convenient option for borrowers.

- Transparent Fees: Sunshine Loans maintains transparency in its fee structure, helping borrowers understand the associated costs.

- Personalized Loan Offers: Loans are tailored to individual financial circumstances, promoting responsible borrowing.

Cons

- Limited Loan Amounts: With loans capped at R4,000, the amount may not be sufficient for some borrowers.

- Short Repayment Terms: The emphasis on short-term loans means that repayment periods might be brief, potentially posing challenges for some borrowers.

- Accessibility: As an online platform, those without internet access or who are not tech-savvy may find it challenging to access services.

Sunshine Loans stands out as a viable option for short-term borrowing, combining efficiency, transparency, and a customer-centric approach in its services. Their commitment to simplifying the borrowing process, alongside their dedication to responsible lending practices, underscores their credibility as a reputable short-term loan provider in the financial market.

On the partner site

Best MFOs

- «SunShine» - Loan company summary:

- Experiences with Sunshine Loans

- Who Can Apply for a Sunshine Loans Loan?

- Differences from Other Loan Providers

- What Makes Sunshine Loans Unique?

- Advantages of Choosing Sunshine Loans

- Types of Loans Offered by Sunshine Loans

- Requirements for a Sunshine Loans Loan

- Simulation of a Loan at Sunshine Loans

- Security and Privacy

- How Much Money Can I Request from Sunshine Loans?

- How Long Does It Take to Receive My Money from Sunshine Loans?

- How Do I Repay My Loan from Sunshine Loans?

- Pros and Cons